Friday, December 23, 2005

Wednesday, December 14, 2005

Short the bond

The fed raises for a 13th time to try and cool the housing market and what did the bonds do?? go up +1 ^03?! Everyone is saying the CPI will come in tame tomorrow with energy prices being down the previous month. I think their could be a spike on the news until the traders start thinking about this months energy prices.

The plan is to short 1/2 position now, and 1/2 into the spike

short ZB 113^01

What now?

MARKET OUTLOOK the year end powers that be want to keep their bonuses and

will continue to prop up this pig of a market in the face of $62 oil , $15

nat gas and a 13th fed tightening. the dollar got pounded after hours and

futures are down. i want to short on any strength with tight stops.

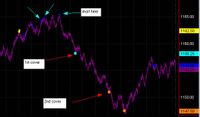

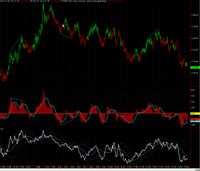

A chart from yesterday from before and after the fed announcement. The $Trin was decreasing all day coiling for an explosive move and we got one.

Fed day gameplan is always cover shorts before announcement, go long... wait 15 min , sell and go short.

will continue to prop up this pig of a market in the face of $62 oil , $15

nat gas and a 13th fed tightening. the dollar got pounded after hours and

futures are down. i want to short on any strength with tight stops.

A chart from yesterday from before and after the fed announcement. The $Trin was decreasing all day coiling for an explosive move and we got one.

Fed day gameplan is always cover shorts before announcement, go long... wait 15 min , sell and go short.

Thursday, September 22, 2005

Wednesday, September 21, 2005

Sunday, August 21, 2005

Tuesday, July 26, 2005

Thursday, July 21, 2005

Wednesday, July 20, 2005

Tuesday, July 19, 2005

Monday, July 18, 2005

Sunday, July 17, 2005

Thursday, July 14, 2005

Tuesday, July 12, 2005

Thursday, July 07, 2005

Wednesday, July 06, 2005

Saturday, July 02, 2005

Friday, July 01, 2005

Thursday, June 30, 2005

Wednesday, June 29, 2005

Monday, June 20, 2005

Friday, June 17, 2005

Sunday, June 12, 2005

Saturday, June 11, 2005

Wednesday, June 01, 2005

Safe Haven | The Fed Opts for Growth, Ignoring Imbalances and Inflation

Safe Haven | The Fed Opts for Growth, Ignoring Imbalances and Inflation

Richard Russell dug up the following quote from Alan Greenspan - from 1996:

"The excess credit which the Fed pumped into the economy spilled over into the stock market -- triggering a fantastic speculative boom. Belatedly, the Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929, the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and consequent demoralizing of business confidence." Alan Greenspan, The Objectivist, 1966

Richard Russell dug up the following quote from Alan Greenspan - from 1996:

"The excess credit which the Fed pumped into the economy spilled over into the stock market -- triggering a fantastic speculative boom. Belatedly, the Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929, the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and consequent demoralizing of business confidence." Alan Greenspan, The Objectivist, 1966

Thursday, May 19, 2005

Monday, May 16, 2005

Sunday, May 15, 2005

bond short note

``There is just a very good bid for Treasuries,'' said Paul Calvetti, head of proprietary Treasury trading at Barclays Capital Inc. in New York. ``They are definitely fundamentally rich, but this situation could persist.''

Concern that the 10-year note was too expensive led Barclays debt strategists on May 13 to recommend ``an outright short'' position, or bets against a further increase in the notes.

Saturday, May 14, 2005

Friday, May 13, 2005

Thursday, May 12, 2005

Monday, May 09, 2005

Saturday, May 07, 2005

Thursday, May 05, 2005

Subscribe to:

Comments (Atom)